A Scam Called Valeant——Why The Casino Is Going To Blow

by David Stockman • March 24, 2016

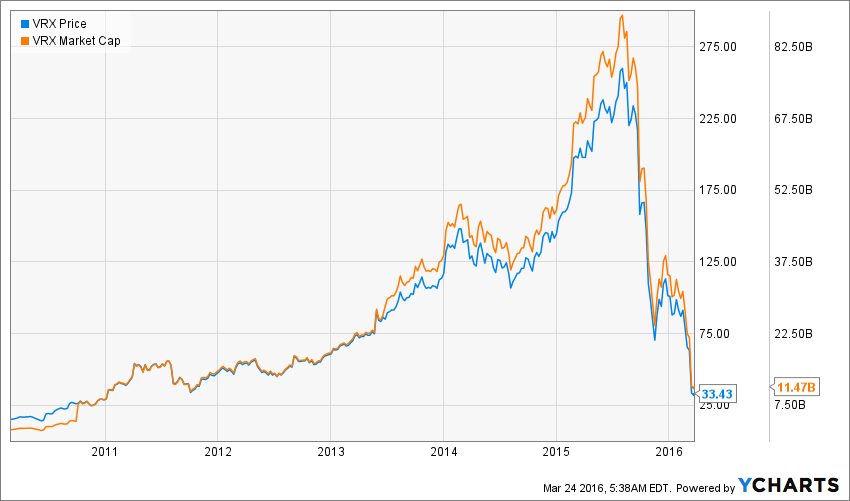

If you need evidence that Wall Street is a financial time bomb waiting for ignition look no further than the recent meltdown of Valeant Pharmaceuticals (VRX). In round terms, its market cap of $90 billion on August 5th has suddenly become the embodiment of that proverbial sucking sound to the south, having plunged to less than $12 billion by Wednesday’s close.

That’s nearly a 90% haircut and VRX was no microcap penny stock. It was a giant inhabitant of a hedge fund hotel.

Needless to say, the cliff-diving pattern in the graph below provides evidence that the ticking bombs in the casino are of the neutron variety. In this case, the hotel may be still standing but the inhabitants have been ionized. On a single day last week, hedge funds lost $5.3 billion in value.

Condign justice, some might say, for the likes of rank gamblers like William Ackman (Pershing Square) and Jeffrey Ubben (ValueAct Holdings) who lost $700 million each that day. The fact that they have successfully promoted themselves for so long as masters of the universe, however, is the real moral of the story.

The financial markets and media have been so corrupted by central bank bubble finance that they did not even recognize that Valeant was a monumental scam and that Ackman and Ubben are snake oil salesman in $5,000 suits. Presently it will become clear that the hedge fund hotels are heavily occupied by many more of the same.

Alas, Valeant wasn’t caught selling poisoned pills or torturing kittens during the last seven months. What it was doing for the past seven years——aggressively pursuing every one of the financial engineering strategies that are worshipped and rewarded in the Wall Street casino——finally came a cropper.

Indeed, Valeant’s evolution during that period arose straight out of the financial engineering playbook. That is, it was a creature of Goldman Sachs and the various dealers, underwriters, hedge funds and consulting firms which ply the Bubble Finance trade.

At the end of the day, the latter have turned the C-suites of corporate America into gambling dens by attracting, selecting and rewarding company-wrecking speculators and debt-crazed buccaneers to the top corporate jobs.

In this case, the principal agent of destruction was a former M&A focussed consultant from McKinsey & Co, Michael Pearson, who became CEO in 2008.

Pearson had apparently spent a career in the Dennis Kozlowski/Tyco school of corporate strategy. That is, advising clients to buy, not build; to slash staff and R&D spending, not invest; to set ridiculously ambitious “bigness” goals such as taking this tiny Canadian pharma specialist from its $800 million of sales to a goal of $20 billion practically overnight; and to finance this 25X expansion with proceeds from Wall Street underwriters, not internally generated cash.

He even replicated the Tyco strategy of moving the corporate HQ to Bermuda to slash its tax rate.

Pearson’s confederate in this scorched earth corporate “roll-up” enterprise was Howard Schiller, a 24-year veteran of Goldman Sachs, who became CFO in 2011, and soon completed the conversion of Valeant into a financial engineering machine.

During their tenure, Pearson and Schiller spent about $40 billion on some 150 acquisitions. And exactly what common expertise and value added leverage did these far flung acquisitions in contact lenses, ophthalmological therapies, dermatology, cosmeceuticals, anti-aging creams, Botox equivalents, acne fighters, toenail fungus ointments and much more bring to the table?

Well, what they brought was an opportunity to slash thousands of jobs, eliminate R&D and fund massive amounts of goodwill and intangible assets with cheap debt. Most especially these deals enabled Valeant to fill its purchase accounting “cookie jars” with fulsome amounts of reserves that could thereafter be used to cause inconvenient integration costs to disappear, as needed.

Indeed, Valeant not only failed to acquire any significant pharmacuetical synergies, but actually went in the opposite direction. That is, it has militantly eschewed investment in drug research and development in an industry who’s very purpose is the development of new drugs and therapies.

Yet the alternative strategy they peddled to the occupants of the hedge fund hotel that became increasingly crowded with VRX punters as its shares soared skyward was downright nonsensical and economically vapid. It could only have thrived during the late stages of a Bubble Finance mania.

In essence, Pearson and Schiller claimed that the rest of the industry was infinitely stupid, and that tens of billions of market cap could be created instantly by the simple expedient of buying companies with seasoned drugs and then jacking up prices, often by orders of magnitude.

In fact, Valeant has acquired a reputation for ferociously raising prices. In one year alone the company jacked-up the price of 81% of the drugs in its portfolio by an average of 66%.

The point here is not to echo the Hillary Chorus in favor of government drug price controls. Quite the contrary. Despite a crony capitalist inspired patent regime and the endless legal obstacles thrown up by the Big Pharma cartel, the drug market is not immune to the laws of economics.

Raise the price of drugs radically enough and you will eventually attract competitors into the market with new formulations that circumvent the patent; or get greedy enough and generics will swamp you on the patent’s expiration.

Stated differently, what seasoned industry executives know that may have escaped the attention of Wall Street hot shots like Pearson and Schiller or the spreadsheet jockeys who congregate in the hedge fund hotels, is that massive, wanton, overnight price escalation is not a business strategy that builds sustainable value and reinforces brand equity; it’s a scalping tactic that works in the casino, but not the real world.

At the same time, Pearson and Schiller slashed staff and chopped down R&D spending to a comically low 3% of sales. That compares to an industry norm of 12% to 18%.

Finally, this Wall Street witches brew was stirred together in pro forma financials that assumed these predatory price hikes would be permanent and that these back-of-the-envelope cost savings would be immediately realized in full.

The resulting profit projections, of course, had virtually nothing to do with the company’s actual results, but they did conform to sell-side hockey sticks like a hand-in-glove. Thus, in 2014 it earned only $912 million under GAAP accounting principles, but claimed “cash” earnings of $2.85 billion.

The latter meant that at its peak market cap in mid-2015 it was trading at a sporty 32X earnings, but not really. It was actually being valued in the casino at 101X the type of profits you don’t go to jail for when you report them to the SEC.

Needless to say, on the back of that kind of financial scamming, it did not take long to turn Valeant into a veritable debt-mule. Its debt outstanding rose from $400 million in 2009 to $31 billion at present, and that 78-fold eruption of debt is the skunk in the woodpile.

To wit, Valeant has been a veritable cash burning machine during its Wall Street driven M&A spree.During the 12 months ending in September, for example, VRX generated only $2.54 billion of operating cash flow, but spent $14.3 billion of cash on CapEx, M&A deals and other investments.

Nor was that an aberration. During the 27 quarters since the end of 2008, VRX has generated a mere $7 billion in operating cash flow, but has consumed nearly $26 billion of cash on investments and deals. Stated differently, it was a Wall Street Ponzi pure and simple.

Likewise, during that 27 quarter period, which roughly tracks Pearson’s tenure, the company has posted rapidly rising sales—-with the top line growing from $757 million in 2008 to $10 billion in its most recent LTM report.

But it has been an absolutely profitless prosperity—–not unlike the typical financial engineering driven roll-up. Thus, over this 27 quarter period as a whole, sales totaled just under $30 billion, but its cumulative net income amounted to a miniscule $130 million.

That’s right. Over the last seven years, Valeant’s GAAP profits have amounted to just 0.4% of sales.

So why did Valeant’s market cap soar from $1.2 billion, when Pearson arrived in 2008, to the recent peak of $90 billion during a period when the company has generated hardly a dime of profits?

It was just another case of Wall Street financial engineering and speculative hype at work. The entire story has been based on pro forma, ex-items forward looking Wall Street hockey sticks, and not the least those published by Goldman Sachs.

It goes without saying, of course, that these Bubble Finance deformations have resulted from the lunatic cheap money and wealth effects levitation policies of the Fed. Financial repression and QE deeply subsidize corporate borrowing to fund financial engineering deals, thereby reducing the after-tax cost of even sub-investment grade debt to low single digit levels.

Likewise, ZIRP is the mother’s milk of Wall Street speculation. It enables hedge funds and other fast money traders to build-up positions in rocket ships like Valeant at virtually no cost through the options and dealer financing markets.

Indeed, as VRX’s market cap grew from $14 billion to $90 billion in just 36 months from mid-2012 to mid-2015, it generated a daisy chain of rising “collateral” value that enabled leveraged speculators to chase its stock to an ever more absurd height relative to the company’s GAAP financials.

Yet there is no mystery as to why these financial engineering scams happen over and again in financial markets which have been corrupted and disabled by the Fed and other central banks.

Namely, because the deal fees from financial engineering are so lucrative; and because the checks and balance of a healthy free market in finance——such as short-sellers, heavy hedging expense and meaningful carry costs for debt financed speculations—–have been destroyed by the central banks.

Needless to say, Valeant is not a one-off aberration. It is the epitome of today’s speculation swollen and highly combustible financial markets.

Yet the all-powerful central bank which has fueled this dangerous, unhinged casino is now being led by a Keynesian school marm stumbling around in an explosives vest. She apparently has no idea that a 38 bps money market rate is not a pump toggle on some giant bathtub of GDP; it’s an ignition fuse that is fueling the greatest speculative mania in modern history.

As I said earlier this week:

Given the overwhelming facts on the ground—–4.9% unemployment, 2.3% core CPI and a 23.7X PE multiple on the S&P 500—-her decision to “pause” after 87 months of ZIRP actually proves she is a blindfolded monetary arsonist—-armed, dangerous and lost.

Janet and her posse of pettifoggers don’t even have the “Humphrey-Hawkins made me do it” excuse any longer. The truth is, there is nothing in the act that says they must hit 2.00% inflation to the second decimal point or anything else more specific than “stable prices”. Nor is there any quantitative target for full employment, let alone something like 4.85%—- since we apparently are not there at 4.90%.

But even if these targets are taken as a serviceable approximations of its so-called ‘dual mandate’, who in their right would be quibbling about the second decimal point so late in the recovery cycle that the next recession is fairly palpable? .

Simple Janet is lost in a time warp. The 1960’s notion that the US economy is a closed bathtub in which inflation, unemployment and all of the other crude, ill-measured macro-variables on Janet’s dashboard can be mushed around by central bank injections of ethers called “aggregate demand” and “financial accommodation” was not true even back then.

It was also never true that the financial market is merely a neutral transmission channel to the main street economy that can be used as a pumping device to manage GDP and the dual mandate variables embedded in it.

In fact, financial markets are the delicate mainspring of the entire capitalist economy. The nuances of pricing in the money and debt markets, the exact shape of the yield curve, the cost of carry and maturity transformations, the price of options and hedging insurance, capitalization rates on earnings and cash flows and much more are what actually enable sustainable growth, real wealth creation and financial stability.

But the blunderbuss Keynesians who have taken control of the Fed and other central banks lock, stock and barrel are clueless. Their massive, chronic, heavy-handed intrusions in financial markets have falsified all prices and turned the financial markets into incendiary gambling casinos. There is no true price discovery left—-just an endless cycle of speculation and front-running that eventually reaches a breaking point and implodes.

We are there now. Valeant’s spectacular implosion didn’t happen on another planet. To the contrary, it’s a product of what the Wall Street casino does.

|